What can PPPs add in pursuit of the SDGs?

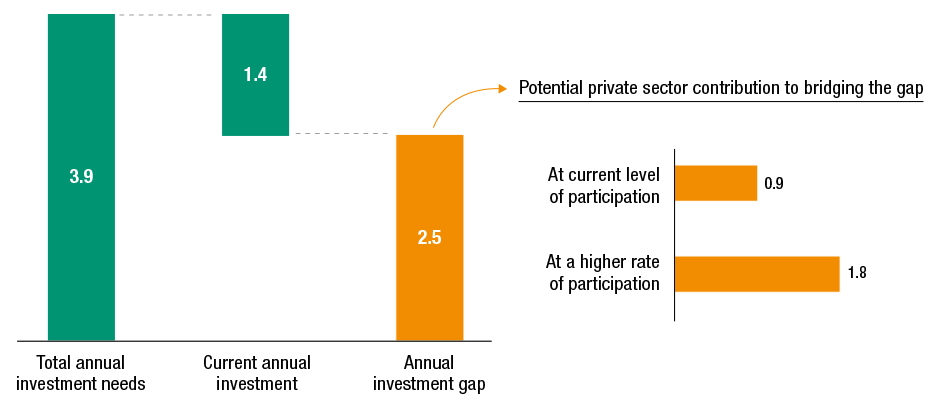

PPPs are not new forms for financing and implementing large infrastructure projects, but in view of tight public budgets and financing shortages for essential infrastructure, they have gained increasing attention of policy makers. This is particularly so in view of the SDG-investment gap of $2.5 trillion annually for developing countries alone (see figure I.1). [1]

Figure I.1: Estimated annual investment needs and potential private sector contribution 2015-2030 (trillions of dollars)

Source: © UNCTAD, WIR 2014, figure IV.3.

Some communities or groups are particularly vulnerable to financing shortages for essential infrastructure.

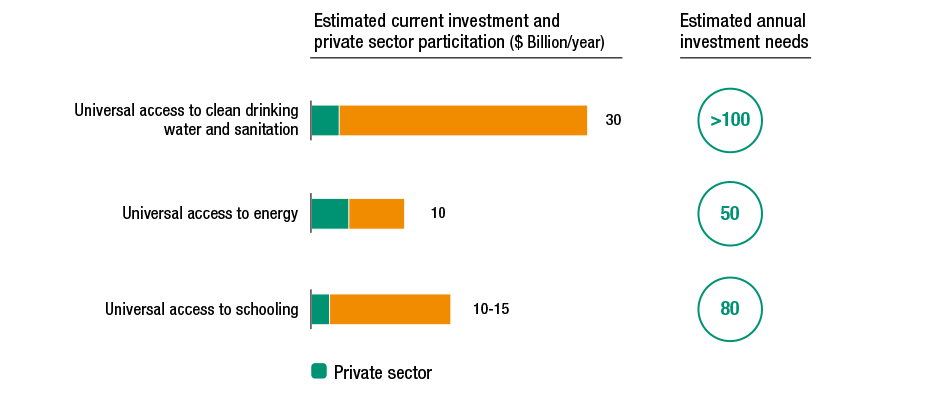

In determining how private sector contribution may add to the pursuit of the SDGs, the goals aimed at addressing the needs of vulnerable individuals and communities (such as those focusing on energy, water and sanitation, gender and equality) need be carefully considered. [2]

UNCTAD data shows that private sector contribution in key SDG areas is low (see figure I.2). Private sources of investment can be useful to help close these funding gaps.

Figure I.2: Example of investment needs in vulnerable and excluded groups

Source: © UNCTAD, WIR 2014, figure IV.2.

There is an increasing international consensus on the relevance of PPPs for the promotion of sustainable development.

- The relevance of PPPs was highlighted by States in the Addis Ababa Action Agenda (AAAA) adopted at the Third Conference on Financing for Development: “[B]oth public and private investment have key roles to play in infrastructure financing, including through (…) public private partnerships (…) Projects involving blended finance, including public-private partnerships, should share risks and reward fairly, include clear accountability mechanisms and meet social and environmental standards. We will therefore build capacity to enter into public-private partnerships, including with regard to planning, contract negotiation, management, accounting and budgeting for contingent liabilities. We also commit to holding inclusive, open and transparent discussions when developing and adopting guidelines and documentation for the use of public-private partnerships and to build a knowledge base and share lessons learned through regional and global forums.” [3]

- The Nairobi, the outcome document at UNCTAD’s Fourteenth Conference (UNCTAD XIV), addressed the role that private sector involvement and financing could play for the achievement of the SDGs. [4]

[1] UNCTAD, World Investment Report 2014: Investing in the SDGs: An Action Plan (UNCTAD 2014) 140.

[2] WIR 2014 (n 11) 144-45.

[3] Addis Ababa Action Agenda, Third International Conference on Financing for Development (13-16 July 2015), endorsed by the UN General Assembly in its resolution 69/313 of 27 July 2015, para 48.

[4] UNCTAD, Nairobi Maafikiano, “From decision to action: Moving towards an inclusive and equitable global economic environment for trade and development”, Fourteenth Session, Nairobi 17-22 July 2016, TD/51/Add.2, in particular paras 50 and 68.