Facts on investor–State arbitrations in 2021: With a special focus on tax-related ISDS cases

This IIA Issues Note presents facts on investor–State arbitrations brought under international investment agreements (IIAs), with a special focus on tax-related cases.

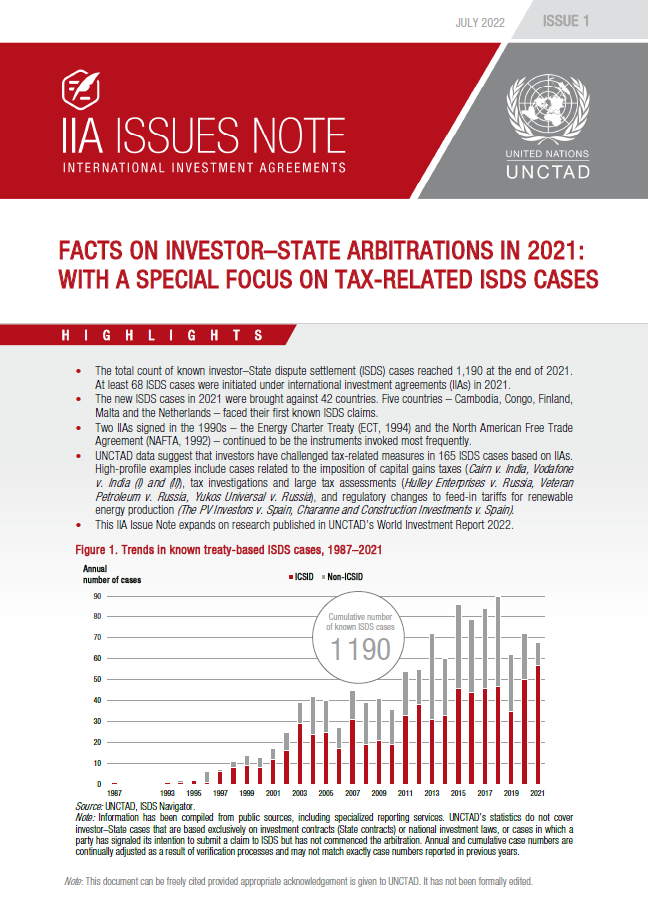

The total count of known treaty-based investor–State dispute settlement (ISDS) cases reached 1,190 at the end of 2021. At least 68 ISDS cases were initiated under IIAs in 2021.

The new ISDS cases in 2021 were brought against 42 countries. Five countries – Cambodia, Congo, Finland, Malta and the Netherlands – faced their first known ISDS claims.

Two IIAs signed in the 1990s – the Energy Charter Treaty (ECT, 1994) and the North American Free Trade Agreement (NAFTA, 1992) – continued to be the instruments invoked most frequently.

UNCTAD data suggest that investors have challenged tax-related measures in 165 ISDS cases based on IIAs. High-profile examples include cases related to the imposition of capital gains taxes (Cairn v. India, Vodafone v. India (I) and (II)), tax investigations and large tax assessments (Hulley Enterprises v. Russia, Veteran Petroleum v. Russia, Yukos Universal v. Russia), and regulatory changes to feed-in tariffs for renewable energy production (The PV Investors v. Spain, Charanne and Construction Investments v. Spain).

This IIA Issue Note expands on research published in UNCTAD’s World Investment Report 2022.

Download bonus chart in excel format (Figure 1. Trends in known treaty-based ISDS cases, 1987–2021)