Treaty-based Investor–State Dispute Settlement Cases and Climate Action

This IIA Issues Note looks at the many past investor–State dispute settlement (ISDS) cases related to measures or sectors of direct relevance to climate action (IIA Issues Note, No. 4).

The urgency of climate action has added attention to the need to reform the international investment agreements (IIA) regime. The risk of ISDS being used to challenge climate policies is a major concern.

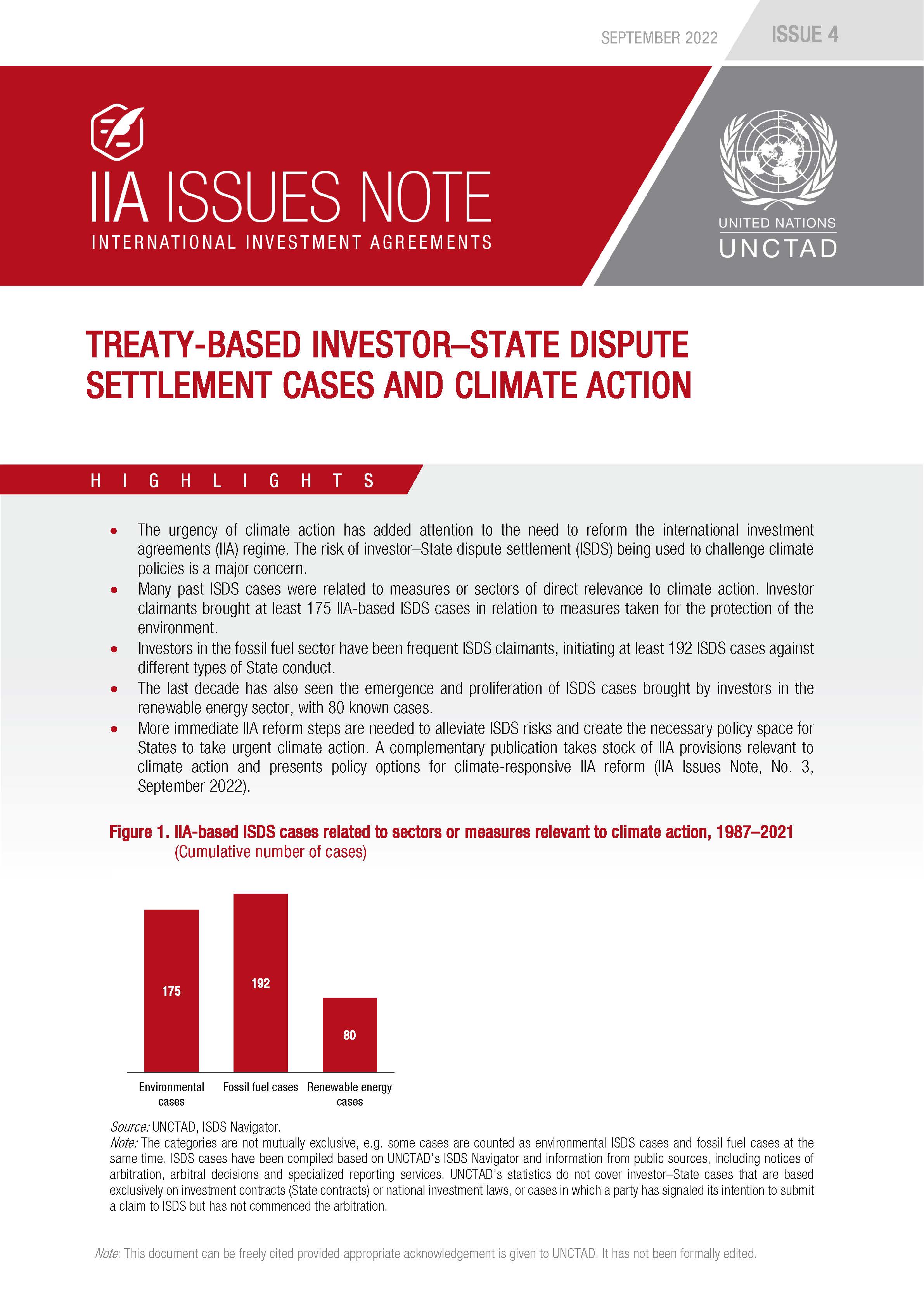

Many past ISDS cases were related to measures or sectors of direct relevance to climate action. Investor claimants brought at least 175 IIA-based ISDS cases in relation to measures taken for the protection of the environment.

Investors in the fossil fuel sector have been frequent ISDS claimants, initiating at least 192 ISDS cases against different types of State conduct.

The last decade has also seen the emergence and proliferation of ISDS cases brought by investors in the renewable energy sector, with 80 known cases.

More immediate IIA reform steps are needed to alleviate ISDS risks and create the necessary policy space for States to take urgent climate action. A complementary publication takes stock of IIA provisions relevant to climate action and presents policy options for climate-responsive IIA reform (IIA Issues Note, No. 3, September 2022).