Investment Facilitation in International Investment Agreements: Trends and Policy Options

This IIA Issues Note takes stock of the increasing share of international investment agreements (IIAs) with investment facilitation features and provides policy options and best practices to focus these provisions on channelling investment toward sustainable development.

Investment facilitation policies are advancing worldwide through international, regional and bilateral initiatives, with prominent examples across all continents. When geared towards sustainable development, investment facilitation features could complement or even provide an alternative to the “investment protection only” approach that is commonly used in the existing stock of IIAs. The overwhelming majority of the 3,200 existing IIAs (of which 2,500 are in force) lack sustainable investment facilitation provisions.

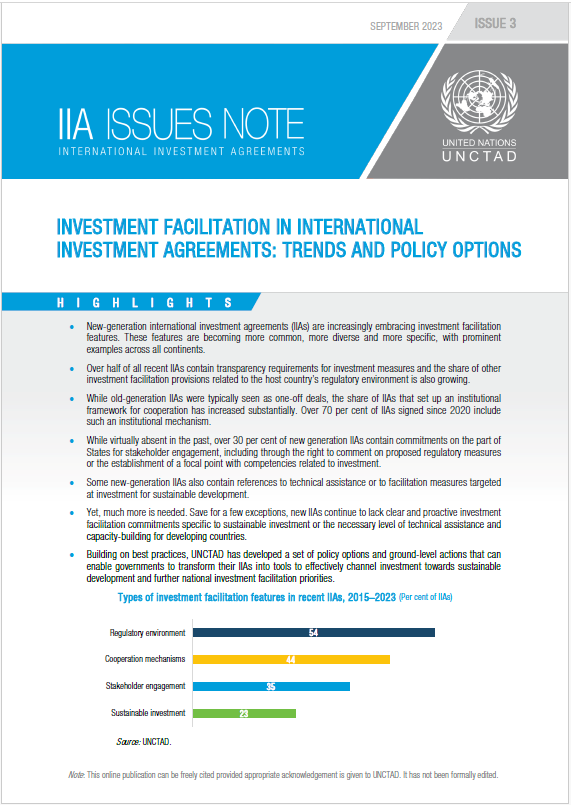

Over half of all recent IIAs contain transparency requirements for investment measures and the share of other investment facilitation provisions related to the host country’s regulatory environment is also growing.

While old-generation IIAs were typically seen as one-off deals, the share of IIAs that set up an institutional framework for cooperation has increased substantially. Over 70 per cent of IIAs signed since 2020 include such an institutional mechanism.

Virtually absent in the past, today over 30 per cent of new generation IIAs contain commitments on the part of States for stakeholder engagement, including through the right to comment on proposed regulatory measures or the establishment of a focal point with competencies related to investment.

Yet, much more is needed. Save for a few exceptions, new IIAs continue to lack clear and proactive investment facilitation commitments specific to sustainable investment or the necessary level of technical assistance and capacity-building for developing countries.

Building on best practices, UNCTAD has developed a set of policy options and ground-level actions that can enable governments to transform their IIAs into tools to effectively channel investment towards sustainable development and further national investment facilitation priorities.