Compensation and Damages in Investor-State Dispute Settlement Proceedings

This IIA Issues Note analyses the trend of growing awards of damages and compensation in treaty-based investor–State dispute settlement proceedings (ISDS) and provides policy options for international investment agreements (IIAs) aimed at countering excessive awards.

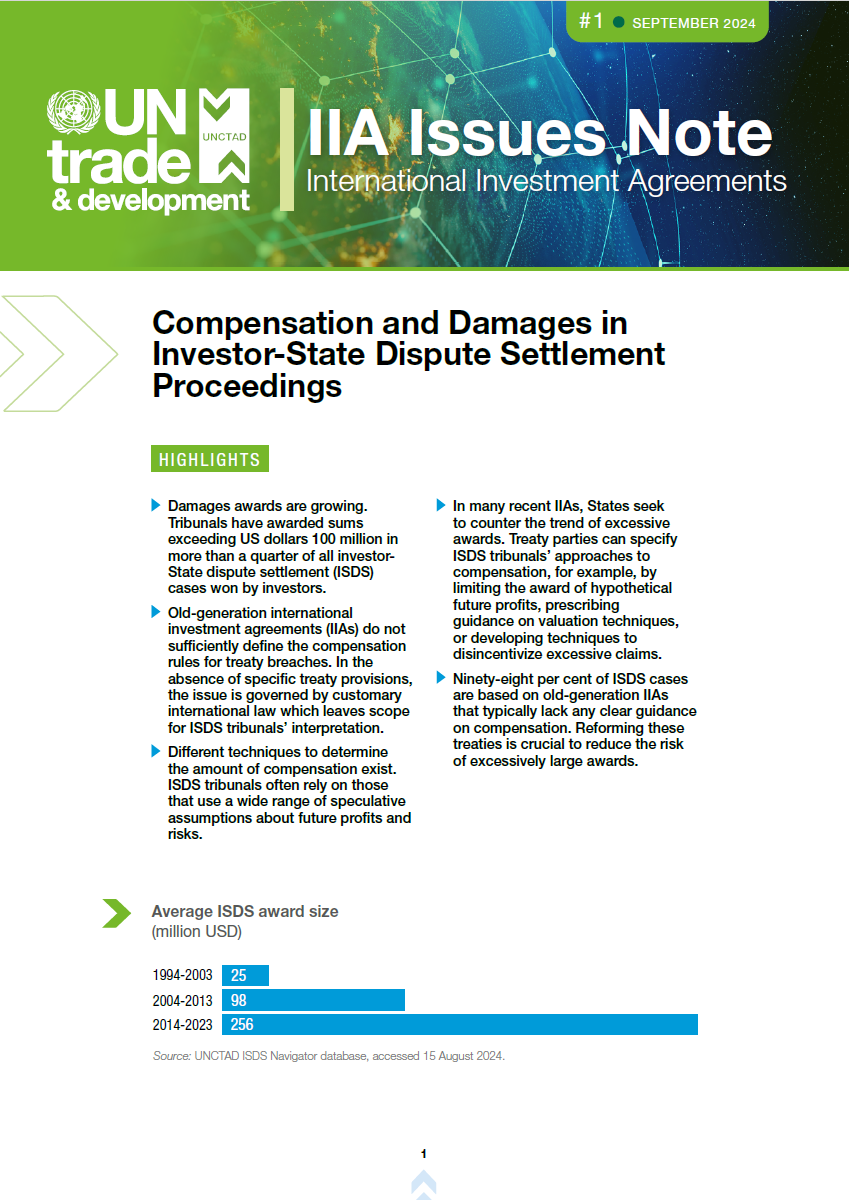

The average award in the decade between 1994 and 2003 stood at US dollars 25 million and has increased tenfold to USD dollars 256 in the decade between 2014 and 2023. Tribunals have awarded sums exceeding US dollars 100 million in more than a quarter of all ISDS cases won by investors.

Old-generation IIAs do not sufficiently define the compensation rules for treaty breaches. In the absence of specific treaty provisions, the issue is governed by customary international law which leaves scope for ISDS tribunals’ interpretation.

Different techniques to determine the amount of compensation exist. ISDS tribunals often rely on those that use a wide range of speculative assumptions about future profits and risks.

In many recent IIAs, States seek to counter the trend of excessive awards. Treaty parties can specify ISDS tribunals’ approaches to compensation, for example, by limiting the award of hypothetical future profits, prescribing guidance on valuation techniques, or developing techniques to disincentivize excessive claims.

Ninety-eight per cent of ISDS cases are based on old-generation IIAs that typically lack clear guidance on compensation. Reforming these treaties is crucial to reduce the risk of excessively large awards.