Mapping of IIA clauses

1. Methodology

The investment policy hub offers a quantitative analysis of IIA clauses with particular relevance to PPPs and gives examples of actual treaty language. We explain the relevance of certain IIA clauses for PPPs, show their prevalence in today’s BITs universe and discuss implications for designing new or modernizing existing BITs that help harness PPPs for sustainable development, while minimizing States’ exposure to ISDS cases.

The research is based on UNCTAD´s IIA Mapping database, which includes over 2,500 mapped BITs.

Only BITs mapped in UNCTAD’s IIA Mapping databases were examined; treaties with investment provisions (TIPs), such as investment chapters of free trade agreements, were excluded.

The IIA Mapping Project is a collaborative initiative between UNCTAD and universities worldwide to map the content of IIAs. The mapping results included in the IIA Mapping Project database serve a purely informative purpose.

The mapping of treaty provisions is not exhaustive, has no official or legal status, does not affect the rights and obligations of the contracting parties and is not intended to provide any authoritative or official legal interpretation.

IIA clauses that are particularly relevant from a PPP perspective include:

- Scope and definition clauses, which have an impact on whether PPPs are covered by an IIA.

- Fair and equitable treatment (FET) clauses, which are the most frequent basis of ISDS claims and most directly touch on interaction (e.g. tender phases) between the government and the private investor (e.g. in the course of public tenders), typical of PPPs.

- “In accordance with domestic law” clauses and “anti-corruption” clauses, which can help strengthen the investor responsibility dimension of PPPs by attaching legal consequences to investor behaviour.

- Umbrella clauses, which elevate non-treaty commitments (e.g. contractual obligations assumed by the host State) to the treaty level and provide the foreign investor with the possibility to bring an investor-State dispute settlement (ISDS) case should such a commitment be breached.

- ISDS clauses, which entitle investors to initiate international arbitration against the host State in case of an alleged breach of the treaty.

2. Definition of investment

Key message: While the enterprise-based definition is on the rise in recent IIAs, both the enterprise as well as the asset-based definition give IIA coverage to PPPs.

Relevance of an IIA’s scope and definition clause for PPPs:

- For a PPP to be covered by an IIA, it would need to fall under the definition of investment set out in the IIA. In other words, the way in which an IIA’s definition clause is framed impacts on whether a PPP can be subsumed under the IIA.

- The broader the notion of investment contained in a BIT, the more easily investments based on PPP contracts qualify as protected investment and the greater is the potential exposure of host States to ISDS claims in relation to PPPs.

Legal description and examples:

- There are two main approaches that States may take toward the definition of investment: the asset-based and the enterprise-based definition of investment. Under both approaches, the scope of covered/protected investment is typically rather broad and contracts that qualify as PPP under our working definition (see here) will typically fall under the definition of protected investment. (Even contracts that do not qualify as PPP contracts, such as turnkey contracts, are usually considered as protected investment, and often explicitly so.)

Examples for asset-based treaty definitions of investment

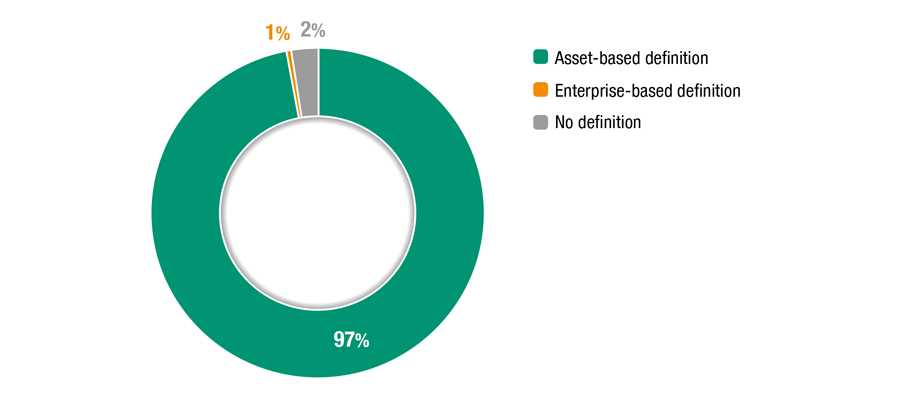

Figure 1: Share of BITs with asset-based, enterprise-based and without definition, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on 2'538 mapped BITs signed between 1959 and 2016.

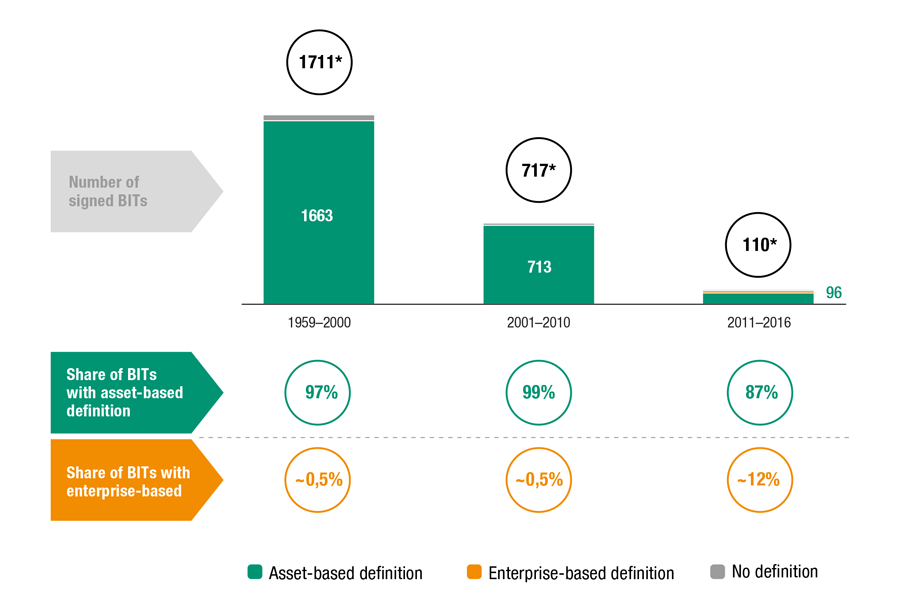

The share of enterprise-based definitions of investment has been on the rise – though still constituting a minority – in BITs concluded between 2011 and 2016 (see figure 2).

Figure 2: Share and numbers of BITs containing asset-based, enterprise-based and no definition, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on 2’538 mapped BITs signed between 1959 and 2016. *Total number of mapped BITs that were signed per period. Note that the presented three options (asset-based, enterprise-based, no definition of investment) are mutually exclusive, a BIT can have either an asset-based or an enterprise-based definition (or no definition at all), but not both.

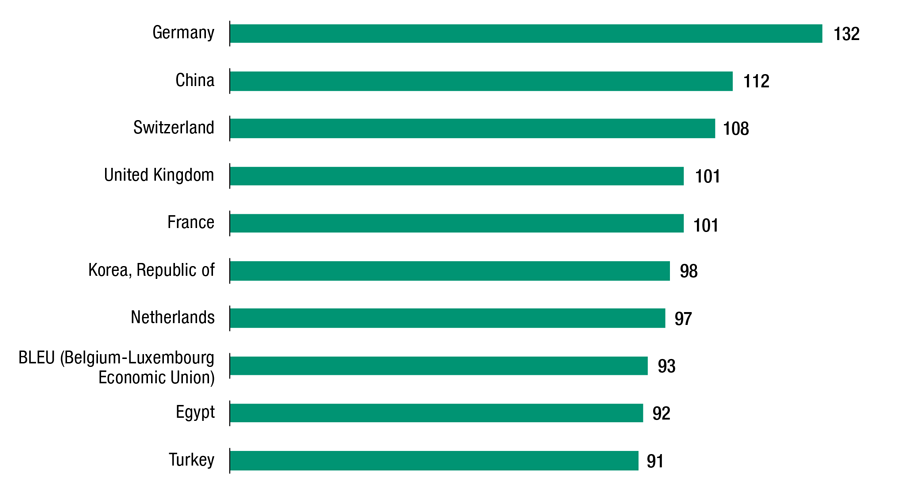

The asset-based definition is frequently used by capital-exporting countries, which typically are also the countries having concluded most BITs (e.g. Belgium-Luxembourg Economic Union (BLEU), China, Egypt Germany, France, Netherlands, Republic of Korea, Switzerland, United Kingdom, and Turkey (see figure 3).

Figure 3: Top ten countries concluding BITs with asset-based investment definition (by number of BITs)

Source: © UNCTAD, IIA Mapping Project.

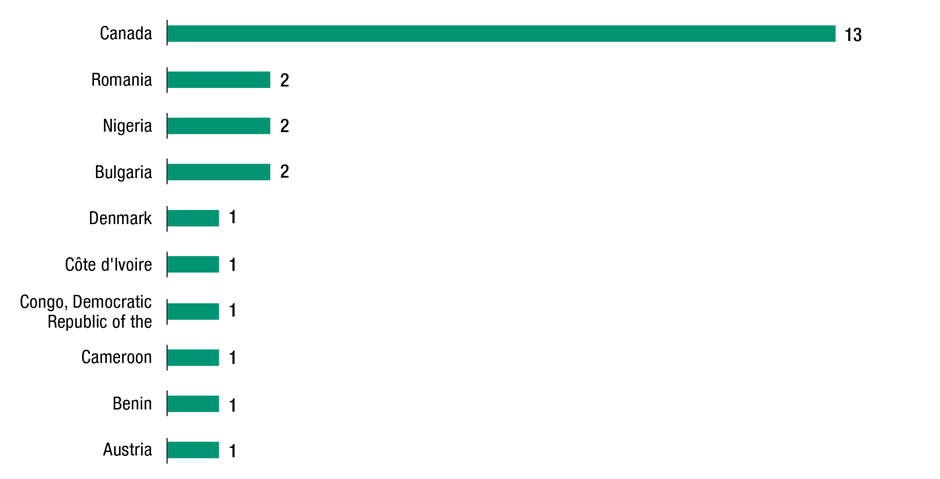

Canada, in turn, is a capital-exporting country that is typically using the enterprise-based definition of investment (13 BITs) (see figure 4).

Figure 4: Top ten countries concluding BITs with enterprise-based investment definition

Source: © UNCTAD, IIA Mapping Project.

3. “In accordance with host State law” and “anti-corruption” clauses

Key message: “In accordance with host State law” clauses, which are frequently found in IIAs, can help ensure that PPPs comply with domestic laws of the host State.

“Anti-corruption” clauses, which are not yet a widely used feature, can help foster the investor responsibility dimension of PPPs.

Relevance of “in accordance with host State law” and anti-corruption clauses for PPPs:

- IIA-based legal consequences to investor behavior, legality requirements (encompassing, among others, “in accordance with domestic law” clauses and “anti-corruption” clauses), can help strengthen the investor responsibility dimension of PPPs.

Legal description and examples:

- PPP contracts are typically subject to the domestic law of the host State (in addition to possibly other sources of law).

- If a BIT contains the requirement that the investment must be (“made”) “in accordance with host State law” and the investor breaches domestic law when making the investment, this will exclude the investment from the protection of the BIT. As a consequence, an arbitrating tribunal seized to decide an ISDS claim in relation to such unprotected investment would dismiss the case for lack of (material) jurisdiction.

- A specific case of breach of host State laws may involve bribery and/or corruption when making the investment.

- In particular tender and bidding processes for PPP contracts, are project phases that susceptible to acts of bribery or corruption to achieve the awarding of the contract.

- Most domestic pacts prohibit such practices, and an investment made through recourse to bribery or corruption would thus typically not qualify as protected investment under a BIT containing an “in accordance with host State law” clause, even if it does not explicitly mention corruption. [Even in the absence of an “in accordance with host State law” clause, arbitrating tribunals denied protection to investments made through recourse to bribery and/or corruption on grounds of violation of international public order.]

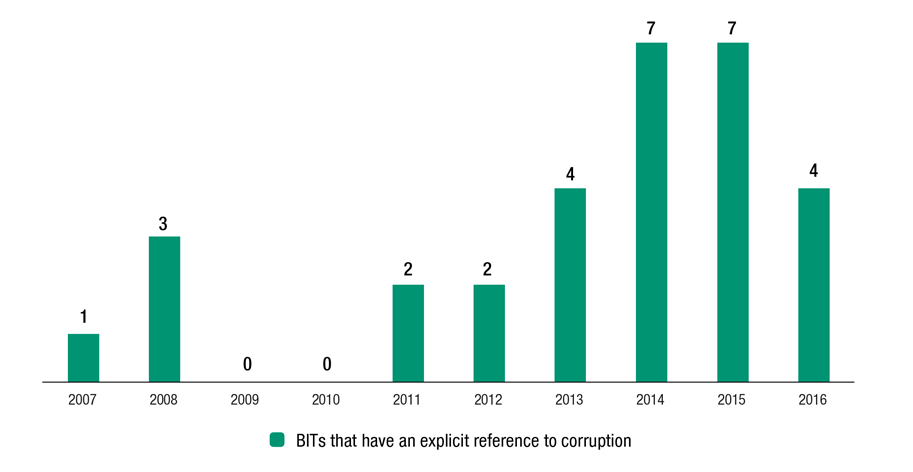

- Some recent BITs have started to address the issue of anti-corruption explicitly, mostly through its inclusion in corporate social responsibility (CSR) clauses (see e.g. Japan-Uruguay (2015) or Canada-Mongolia (2016)). A few BITs explicitly exclude the investment from the scope of protected investment or from the access to ISDS in the case of corruption or bribery (see e.g. Morocco-Nigeria BIT (2016) or Iran-Slovakia BIT (2016)).

Examples for “in accordance with host State law” clauses

Data:

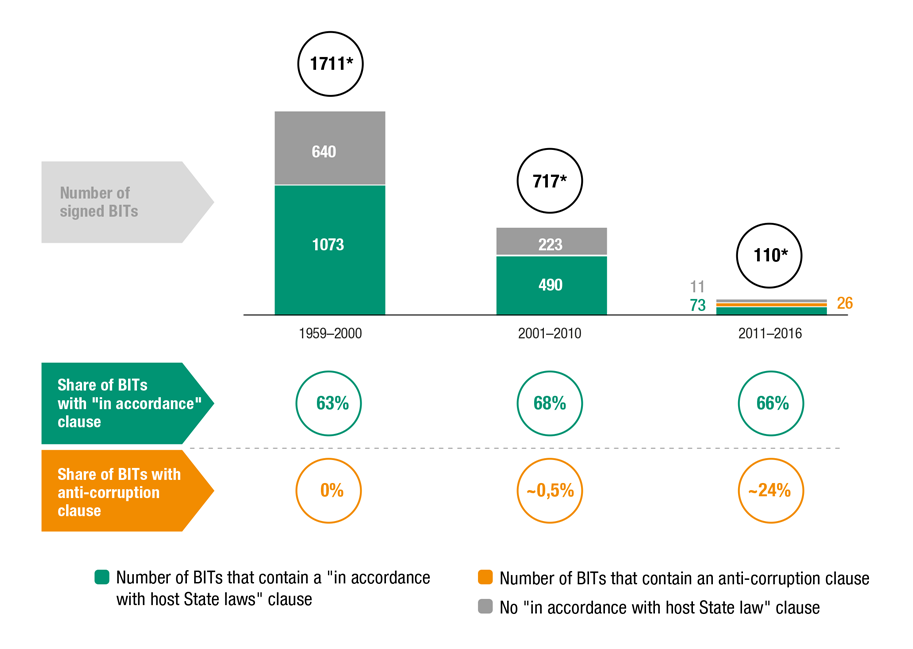

The majority of BITs contain “in accordance with host State law” clauses, though anti-corruption clauses are on the rise in new-generation BITs (see figure 5).

Figure 5: Number and share of BITs containing an “in accordance with host State law” and/or “anti-corruption” clause, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on 2’538 BITs signed between 1959 and 2016.

* Total number of mapped BITs that were signed per period. Note that the presented options “in accordance with host State law” clause and no “in accordance with host State law” clause are mutually exclusive, while the options “in accordance with host State law” clause and “anti-corruption” clause are not mutually exclusive. A BIT can therefore have or not have an “in accordance with host State law” clause as well as an “anti-corruption” clause.

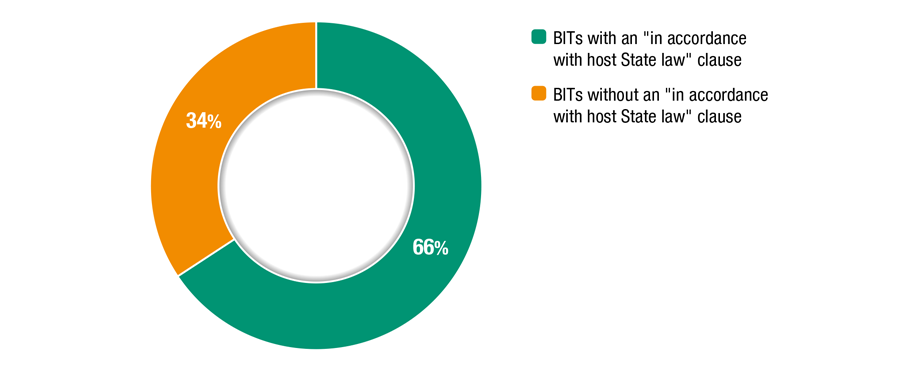

About two-thirds of all BITs signed between 1959 and 2016 contain the requirement that the investment must be made “in accordance with host State law” (see figure 6).

(Many BITs also require additionally that the investment must be admitted in accordance with host State law and a recent few BITs also require that the investment must be made and operated in accordance with host State laws.)

Figure 6: Share of BITs with and without an “in accordance with host State law” clause, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on 2'538 mapped BITs signed between 1959 and 2016.

The inclusion of “anti-corruption” clauses remains a nascent trend and only few BITs currently contain such clauses (see figure 7).

Figure 7: Number of BITs that have an explicit reference to corruption, signed between 2007 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on 2'538 mapped BITs signed between 1959 and 2016.

4. Fair and equitable treatment (FET)

Key message: Narrowly drafted FET clauses, which are increasingly prevalent in new-generation IIAs, can help reduce States’ exposure to ISDS claims based on PPPs.

Relevance of FET clauses for PPPs:

- Fair and equitable treatment clauses touch directly on interaction between the government and the private investor (e.g. in the course of public tenders) typical of PPPs. FET is also the IIA clause on which ISDS claims are most frequently based.

- PPP projects are characterized by regular, and sometimes intense, interactions between the private investor and government authorities. This applies to the pre-project phase (e.g. bidding and tendering process for a project), throughout the life-cycle of the project (e.g. application or renewal of licenses or concessions), or to the end of the project (e.g. termination of the contract by the authorities, etc.).

- In these interactions, the investor may feel it was treated in an unfair or inequitable manner by the government authority, e.g. because it had legitimate expectations that it would get awarded the contract or that a license would be renewed, or that the termination of the contract was in breach of the contractual terms.

Legal description and examples:

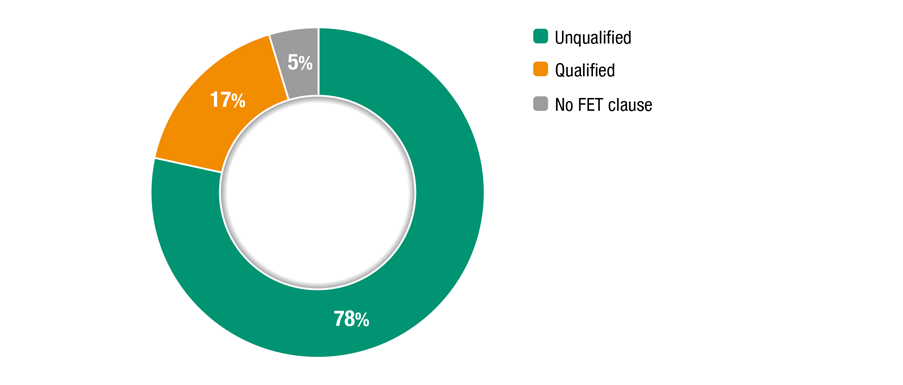

- Most of the FET clauses are unqualified, i.e. they do not spell the legal standard against which State conduct is to be assessed. This vagueness has given rise to expansive and widely diverging arbitral interpretations of what can be considered a breach of FET.

- More recently negotiated BITs have therefore started to use more focused wording, either by linking the content of the FET obligation to the minimum standard of treatment or customary international law and/or by listing explicitly the type of treatment that constitutes a breach of FET (qualified FET clauses). In particular, the latter has the potential of limiting the host State’s exposure to PPP-related ISDS claims to specific grounds of alleged administrative or judicial shortcomings or failures (such as denial of justice or manifest arbitrariness).

Examples of qualified and unqualified FET clauses

Data:

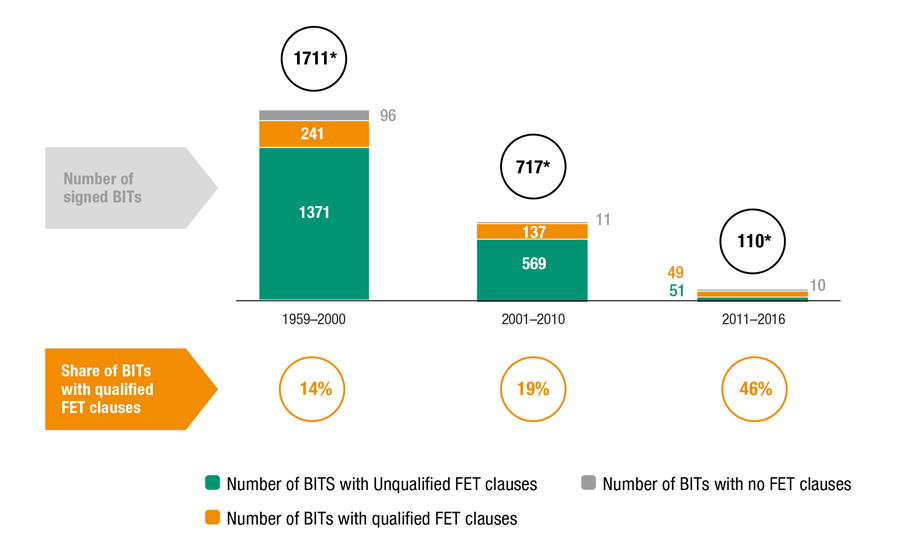

Unqualified FET clauses still constitute the majority (four-fifth) of all BITs signed between 1959 and 2016 (see figure 8).

Figure 8: Share of BITs with unqualified, qualified and no FET clauses, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on 2'538 mapped BITs signed between 1959 and 2016. "Qualified" FET clauses refer to clauses containing reference either to the minimum standard of treatment/customary international law or a list of prohibited conduct.

However, in view of the legal uncertainty created by diverging arbitral interpretations of unqualified FET clauses, qualified FET clauses have been on the rise in new-generation BITs, in line with UNCTAD’s Roadmap for IIA Reform (WIR15) and the Investment Policy Framework for Sustainable Development (2015).

Indeed, for BITs concluded between 2011 and 2016, slightly more BITs now include qualified FET clauses than unqualified ones.

Figure 9: Number and share of BITs with unqualified, qualified and no FET clause, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on 2'538 mapped BITs signed between 1959 and 2016. "Qualified" FET clauses refer to both clauses containing reference to the minimum standard of treatment/customary international law and containing lists of treatments that constitute breaches of FET.

* Total number of mapped BITs that were signed per period.

5. Umbrella clauses

Key message: The absence of umbrella clauses, which is typical for new-generation treaties, helps reduce States’ exposure to PPP-related, contract-based ISDS claims.

Relevance of umbrella clauses for PPPs:

- By elevating non-treaty commitments (such as contractual obligations assumed by the host State) to the treaty level, umbrella clauses entitle the foreign investor to bring an ISDS case in the event of breach of this commitment.

Legal description and examples:

- If the State commits a breach of the PPP contract, normally the contract foresees its own dispute resolution mechanisms and remedies. However, if an applicable BIT contains an umbrella clause, it may be possible for the investor to bring a treaty-based ISDS claim instead.

Data:

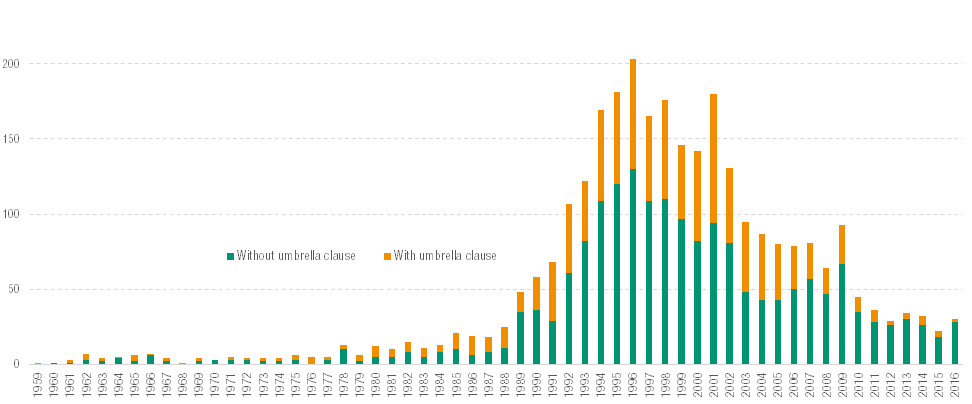

Umbrella clauses were used extensively in old-generation BITs (in particular in BITs concluded in the 1980s and 1990s) (see figure 10).

Figure 10: Evolution of BITs with umbrella clause, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project.

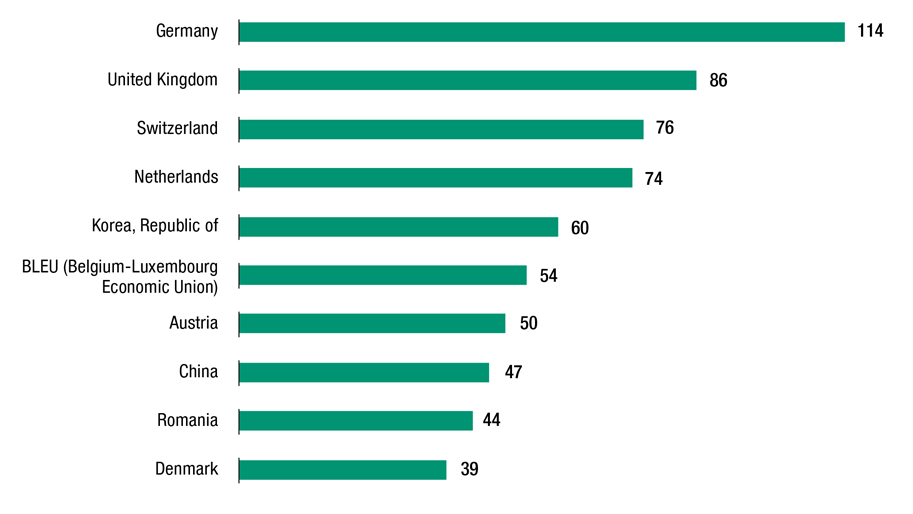

Umbrella clauses are frequently used by capital-exporting countries which typically are also the countries having concluded most BITs (e.g. Germany, United Kingdom, and Switzerland) (see figure 11).

Figure 11: Top ten countries concluding BITs that contain umbrella clauses

Source: © UNCTAD, IIA Mapping Project.

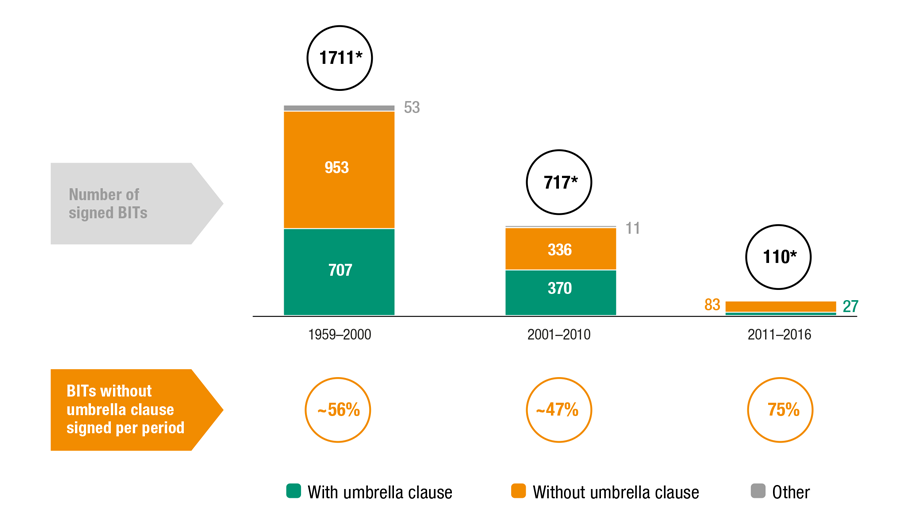

Because umbrella clauses considerably heighten host States’ exposure to ISDS claims, many States have stopped including them in new-generation BITs (see figure 12).

This is a clear trend that is also in line with UNCTAD’s Roadmap for IIA Reform and the Investment Policy Framework for Sustainable Development (2015).

Figure 12: Number and share of BITs with and without umbrella clause, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on a total of 2'538 BITs signed between 1959 and 2016. The category "Other" concerns BITs that were mapped as "inconclusive" or "not applicable". *Total number of mapped BITs that were concluded per period.

6. Investor-State dispute settlement clauses

Key message: Narrowly framed dispute settlement (DS) clauses, which are on the rise in recent IIAs, help limit States’ exposure to ISDS claims.

Relevance of ISDS clauses to PPPs:

- BITs typically determine which kind of disputes the contracting States agree to submit to investor-State arbitration.

Legal description and examples:

- Some ISDS clauses cover a wide range of disputes, effectively extending to any dispute between a foreign investor and the host State in relation to the investment (whether contract or treaty-based) (broad DS clause). This kind of DS clause creates a potentially high exposure of host States to ISDS claims.

- Other DS clauses list the specific bases of possible claims an investor can bring to investor-State arbitration.

- Yet other DS clauses are even more narrow, extending the host State’s consent only to specified, typically only treaty-based disputes.

- Whether an ISDS clause is broadly or narrowly framed determines whether a contracts-based claim by the investor (e.g. an ISDS case involving a “mere” breach of contract) would fall within the host State's consent to arbitration. Accordingly, its drafting may be instrumental in limiting host State’s exposure to ISDS claims.

- A broadly framed ISDS clause or clauses listing possible bases of claims may typically be used by a foreign investor to bring an ISDS claim based on the allegation of either a breach of the BIT or a breach of the investor-State contract (or other legal bases as applicable).

- By contrast, a narrowly framed ISDS clause, extending only to alleged violations of the treaty, normally does not give the investor access to ISDS on the basis of alleged breach of contract (unless the BIT contains an umbrella clause).

Examples of various types of DS clauses

Data:

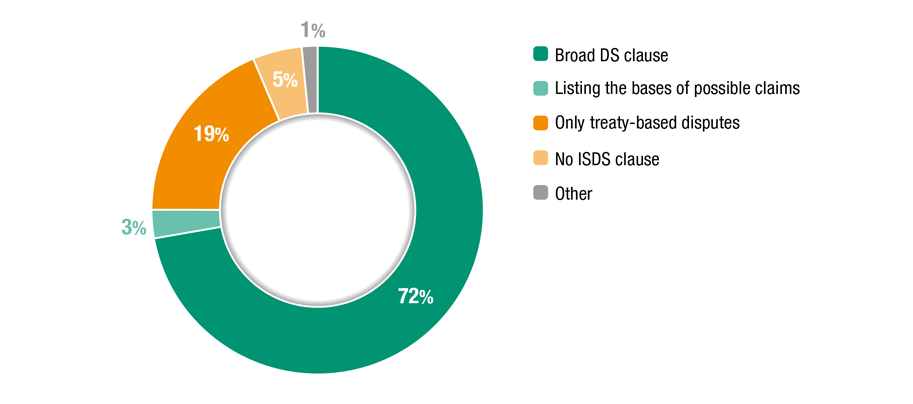

The majority (close to three-quarter) of all BITs contain broad ISDS clauses (see figure 13).

Figure 13: Share of BITs containing broad, list-based, treaty-based-only or no DS clauses, signed between 1959 and 2016

Source: © UNCTAD, IIA Mapping Project. Based on a total of 2'538 BITs signed between 1959 and 2016. The category "Other" concerns BITs that were mapped as "other" or "inconclusive".

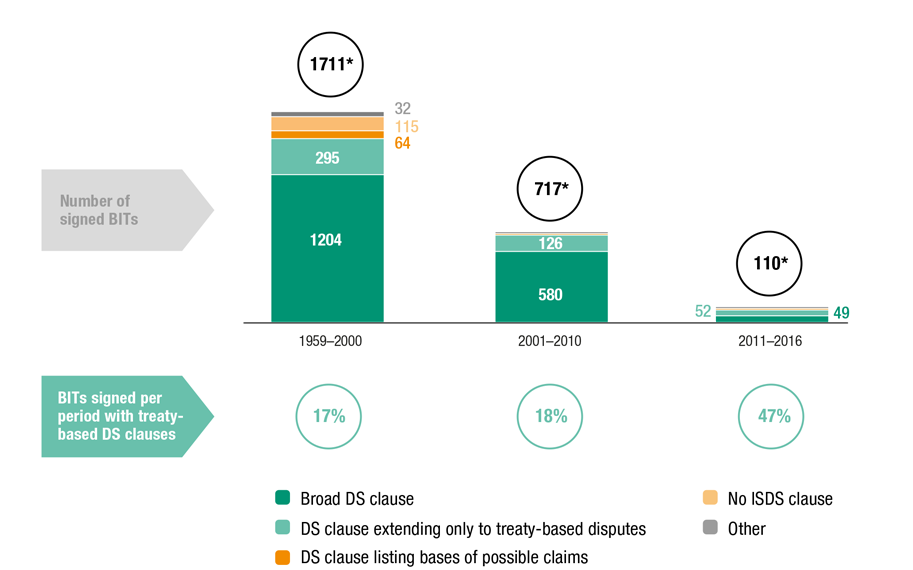

Broad DS clauses are particularly prevalent in older-generation BITs; by contrast, newer-generation BITs increasingly include treaty-based-only DS clauses (see figure 14).

There is the special case of United States BITs, whose ISDS clauses tend to specifically list the bases of possible claims.

Figure 14: Number and share of types of DS clauses in BITs, signed between 1959 and 2016.

Source: © UNCTAD, IIA Mapping Project. Based on a total of 2'538 BITs signed between 1959 and 2016. The category "Other" concerns BITs that were mapped as "inconclusive" or "not applicable".

7. Other clauses that explicitly mention PPPs

Key message: Recent IIAs have started to take account of the importance of PPPs by explicitly mentioning them, mostly as part of clauses dealing with investment promotion and facilitation activities.

Relevance of clauses explicitly mentioning PPPs:

- An explicit mention of PPPs in IIAs highlights the importance that treaty parties give to this kind of cooperative projects and is an element in furtherance of investment for development.

Legal relevance and examples:

- Clauses including references to PPPs most often pertain to the ambit of investment promotion or facilitation.

- Despite the fact that these clauses are typically non-binding, their inclusion is desirable to strengthen the cooperation of treaty partners in the area of investment promotion and facilitation (e.g. transparency, streamlining of administrative procedures etc.).