The increasing dichotomy between new and old investment treaties

30 Oct 2024UN Trade and Development (UNCTAD) has released a new publication on the increasing dichotomy between new and old international investment agreements (IIAs).

In 2023, new-generation IIAs included innovative provisions on investment facilitation and cooperation and tended to safeguard States’ right to regulate.

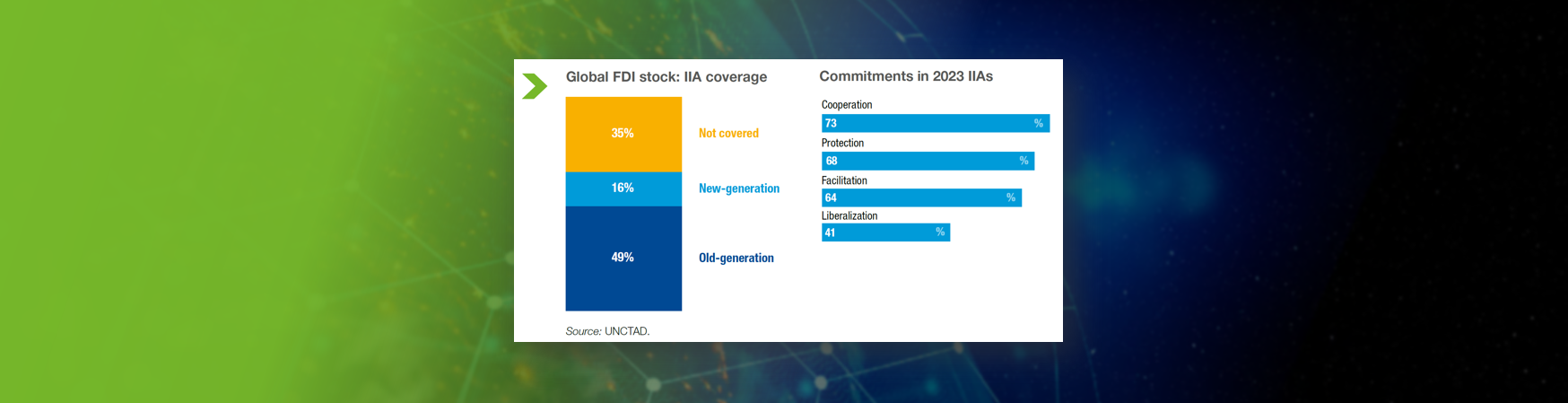

However, old-generation IIAs still cover about half of global FDI stock, making IIA reform more urgent.

For developing countries, this share is higher at 65%, which is 20% more than for developed countries. The gap is even greater for least developed countries (LDCs), where old-generation treaties cover 71% of their FDI stock, exposing them to higher risks of investor-State disputes.

Old-generation treaties account for 97% of all ISDS cases to date, with developing countries as respondents in the majority of them (about 62%). At least 58 ISDS cases have been initiated against LDCs, posing significant financial risks for these vulnerable economies.

The average amount sought by investors in ISDS cases is $1.1 billion, with the average award being $385 million. In at least eight cases, developing countries were required to pay over $1 billion in compensation. By the end of 2023, LDCs had paid a total of $595 million, with one case alone accounting for $270 million.

While new IIAs increasingly include investment facilitation commitments – often promoting digitalization – more effort is needed to align these commitments with sustainable investment and make them operational.

UN Trade and Development (UNCTAD) has developed policy options to help governments leverage facilitation commitments in their IIAs to promote sustainable investment, supported by strategic digitalization.